do nonprofits pay taxes on interest income

Your recognition as a 501 c 3 organization exempts you from federal income tax. For example if a nonprofit purchased 10000 worth of 10 percent bonds using 6000 cash and.

Can A Nonprofit Business Earn Interest On A Checking Account

Did you know that sometimes nonprofits must pay income tax.

. Why do nonprofits not pay taxes. You cash out a matured bond and pay income tax on all interest that accumulated during the original bondholders lifetime. Long-term capital gains come from assets held for over a year.

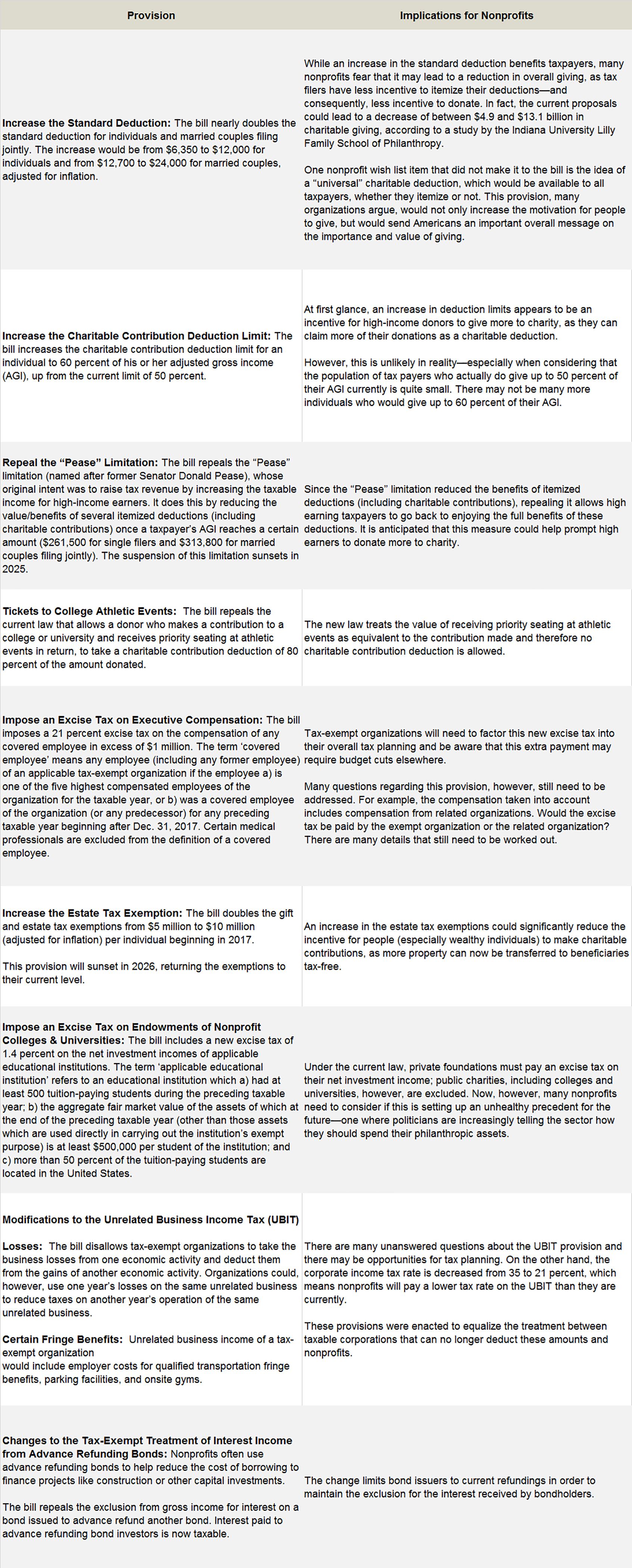

On the next 53404 on income between 97069 up to 150473 29. 20 2019 the excise tax is 2 percent of net investment income but is reduced to 1 percent in certain cases. Do priests have to pay taxes.

On the next 63895 on income between. The nonprofit must recognize taxable income in the proportion that the property is financed. Example You earn 16000 of.

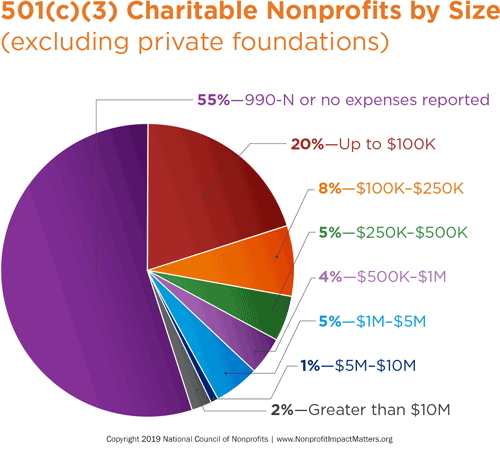

Entities organized under Section 501 c 3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which. Do Nonprofits Pay Taxes. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

However this corporate status does not. But nonprofits still have to pay. Nonprofits are organizations that operate for the collective public and private interest without aiming to generate profits for the founders.

Beneficial interest is defined as stock in a for-profit or voting board positions in a nonprofit. Your starting rate for savings is a maximum of 5000. Failing to pay UBIT on debt-financed property.

Contrary to what the anonymous poster to this question stated the surprising answer is yes. I am going to assume you are talking about a US 501c3 approved charity. Why does paying UBIT on investment income matter.

Exempt function income is gross. Just because you have a tax-exempt status it does not mean that youre well tax. You reissue the bond in your name and pay taxes.

Tax treatment for non-profits. The federal government taxes up to 85 of Social Security payments for seniors who earn more than a specific threshold but never taxes the full benefit. An organization that has to file an NPO information return may also have to file other returns such as a T2 Corporation Income Tax Return a T2 Short Return or a T3 Trust Income Tax and.

Short-term capital gains come from assets held for under a year. Qualifying nonprofits are exempt from paying federal income tax although they may still have to pay excise taxes income tax on unrelated business activities and employment. A church owes income taxes if it has income that is 1 from a trade or business 2 regularly conducted that is 3 not substantially related to their exempt purpose.

You can claim back tax thats been deducted for example on bank interest and donations this is known as Gift Aid. Some taxpayers may have extra time to file their tax returns and pay any taxes due. Every 1 of other income above your Personal Allowance reduces your starting rate for savings by 1.

For tax years beginning on or before Dec. On the next 48535 on income between 48535 up to 97069 26. June 30 2021.

Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types. May not be subject to federal taxes nonprofit organizations do pay employee taxes Social. How much is capital gains in 2021.

Unrelated business income tax rules applicable to organizations exempt under IRC sections 501c7 social clubs and 501c9 and 501c17. Yes nonprofits must pay federal and state payroll taxes. For tax years beginning after Dec.

Answer 1 of 3.

Nonprofit Conflict Of Interest Policy Template Sample For 501c3

Should Nonprofits Seek Profits

What Taxes Do Non Profits Pay Ubti Cg Tax Audit Advisory

What Is A Nonprofit Organization Npo

Can A Nonprofit Business Earn Interest On A Checking Account

Myths About Nonprofits National Council Of Nonprofits

What Are Tax Exempt Organizations Asu Lodestar Center For Philanthropy And Nonprofit Innovation

Infinite Giving Nonprofit Investing The Ultimate Guide To Grow Your Giving

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

How Nonprofits Obtain And Maintain Their Nonprofit Tax Status Hr News

Unrelated Business Income Tax Ubit A Comprehensive Overview For Nonprofits Business Law Today From Aba

Understanding New Revenue Recognition Guidelines For Nonprofits

How Do Nonprofits Make Money Making Nonprofits Profitable Jitasa Group

How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

Full Article Taxation Of Non Profit Associations In An International Comparison

Do Nonprofits Pay Taxes Gocardless

When Does Your Nonprofit Owe Ubit On Investment Income

Taxing Nonprofits Changes In Unrelated Business Income Tax Pro Center Intuit